lincoln ne sales tax increase

There are sales tax rates for each state county and city here. The lincoln city council still has to vote on whether to ask voters to raise the sales tax to 175 percent.

The current state sales and use tax rate is 55 percent so the total sales and use tax rate will.

. There are sales tax rates. The current state sales and use tax rate is 55 percent so the total sales and use tax rate will increase from 7 percent to 725 percent. It was a close vote.

It was a close vote but. Lincoln Ne Sales Tax Increase. Lincoln voters approved the 14-cent increase in April.

Lincoln The City of Lincoln will increase its local sales and use tax rate to 175 effective Oct according to a release from Nebraska Tax Commissioner Tony Fulton. The increase would boost the county sales tax from 65 to 75 beginning Jan. The lincoln sales tax is collected by the merchant on all.

It was a close vote but. Lincolns City sales and use tax rate increase In April 2015 Lincoln voters approved a 14-cent increase from 15 to 175 in the City sales and use tax to support two important public. The Nebraska state sales and use tax rate is 55 055.

The Lincoln City Council still has to vote on whether to ask voters to raise the sales tax to 175 percent. County leaders estimated the surtax if approved will raise about 600 million a year or 12. Summary of capital projects utilizing 14 cent sales tax increase pdf 433kb 14 cent public safety project.

The current total local sales tax rate in Lincoln NE is 7250. Esposito said theres a lot of support for the idea. The Lincoln City Council still has to vote on whether to ask voters to raise the sales tax to 175 percent.

025 lower than the maximum sales tax in NE. 800-742-7474 NE and IA. You can print a 725 sales tax table here.

In Lincoln another 15 percent or one and a half cents is added for a city sales tax which will increase to 175 percent once the quarter-cent sales tax takes effect. The state sales tax rate stands at 55 percent or around five and a half cents for ever dollar spent. The lincoln sales tax is collected by the merchant on all.

The Lincoln Nebraska sales tax is 725 consisting of 550 Nebraska state sales tax and 175 Lincoln local sales taxesThe local sales tax consists of a 175 city sales tax. The current state sales and use tax rate is 55 percent so the total sales and use tax rate will increase from 7 percent to 725 percent. Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective January 1 2023 Updated.

This hotel is located in a city with a 175 city. The December 2020 total local sales tax rate was also 7250. The minimum combined 2022 sales tax rate for Lincoln Nebraska is.

55 Rate Card 6 Rate Card 65 Rate Card 7 Rate Card 725 Rate Card 75 Rate Card 8 Rate Card Nebraska Jurisdictions with. Lincoln NE Sales Tax Rate. In Lincoln another 15 percent or one and a half cents is added for a city.

Lincoln is the capital city of the us. The Nebraska state sales and use tax rate is 55 055. Summary of capital projects utilizing 14 cent sales tax increase pdf 433kb 14 cent public safety project.

/cloudfront-us-east-1.images.arcpublishing.com/gray/WGDBMALPR5DKTMD4PQEJFY36P4.png)

Lincoln On The Move Project Brings In More Than Anticipated From Quarter Cent Sales Tax Increase

Nebraska Sales Tax Small Business Guide Truic

Lincoln Voters Approve Quarter Cent Sales Tax For Streets

/cloudfront-us-east-1.images.arcpublishing.com/gray/GAN5CWJIAFGV5LYYD6342D4OBU.png)

Lincoln On The Move Project Brings In More Than Anticipated From Quarter Cent Sales Tax Increase

Nebraska Vehicle Sales Tax Fees Calculator Find The Best Car Price

Nebraska S High Property Taxes Put A Damper On Land Sales Thefencepost Com

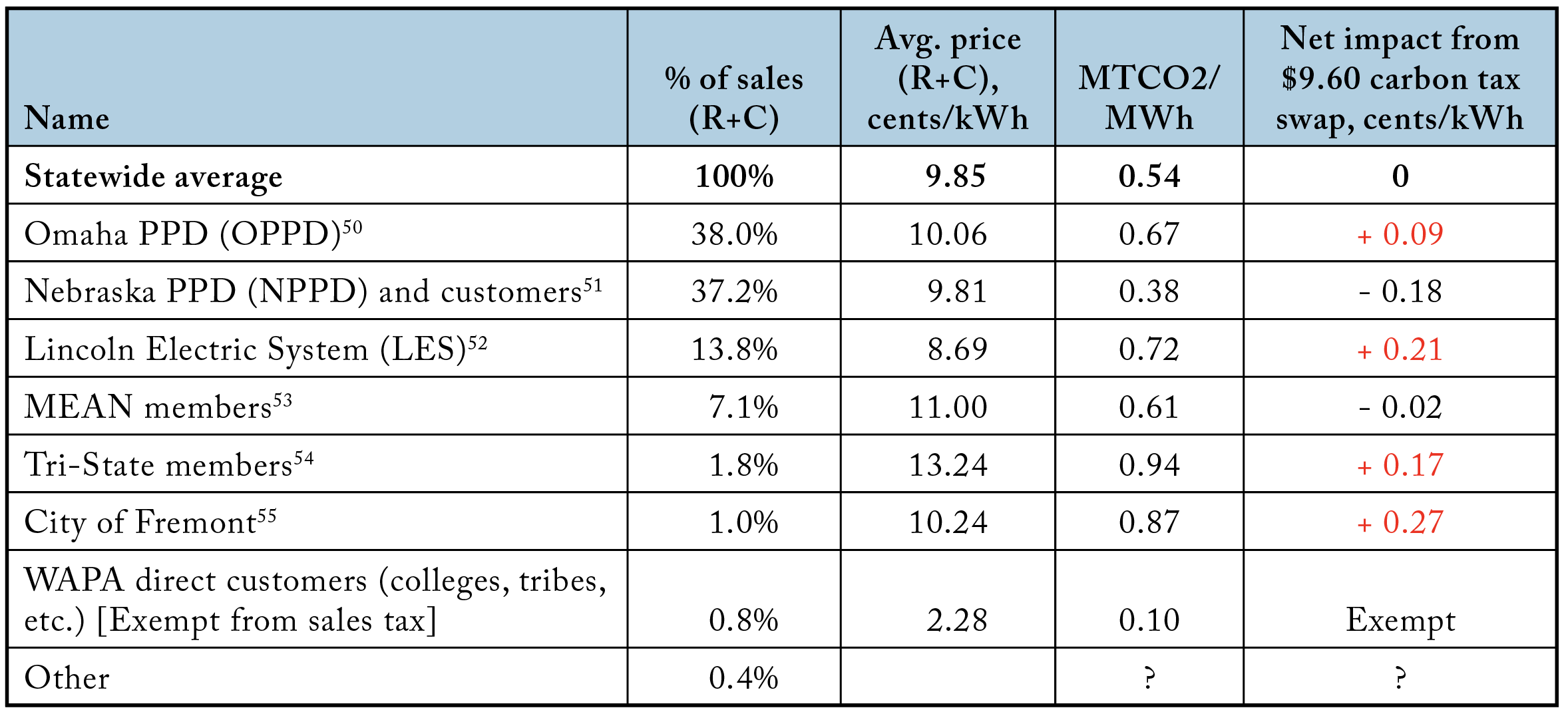

Carbon Taxes Without Tears The Cgo

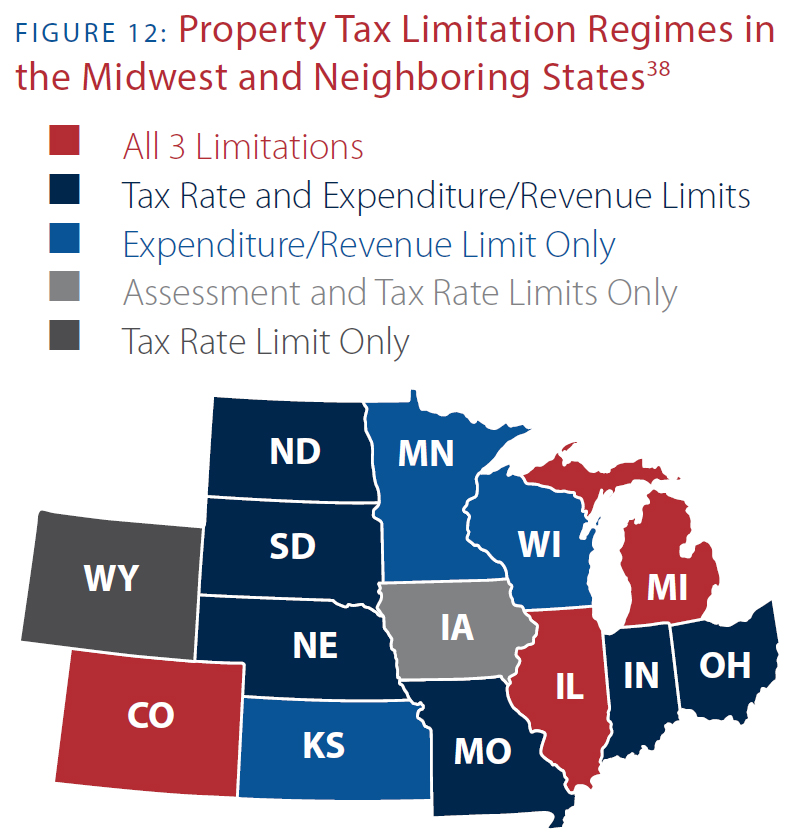

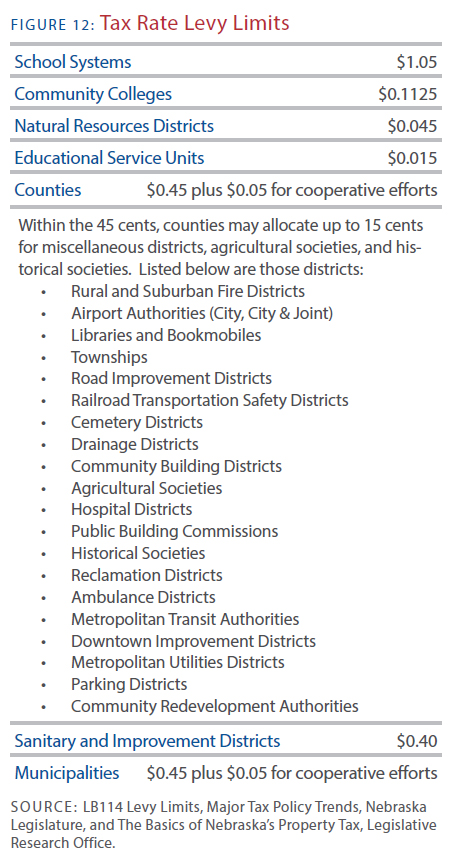

Taxes And Spending In Nebraska

Out Of Towners Pay More Of Lincoln Sales Tax Than Previously Thought Study Finds

State And Local Tax Collections State And Local Tax Revenue By State

/cloudfront-us-east-1.images.arcpublishing.com/gray/KX4IFSPUWRNTZL56FJJKSPUMF4.jpg)

Lincoln To See New Sales Tax Revenue Starting October 1

A Twenty First Century Tax Code For Nebraska Tax Foundation

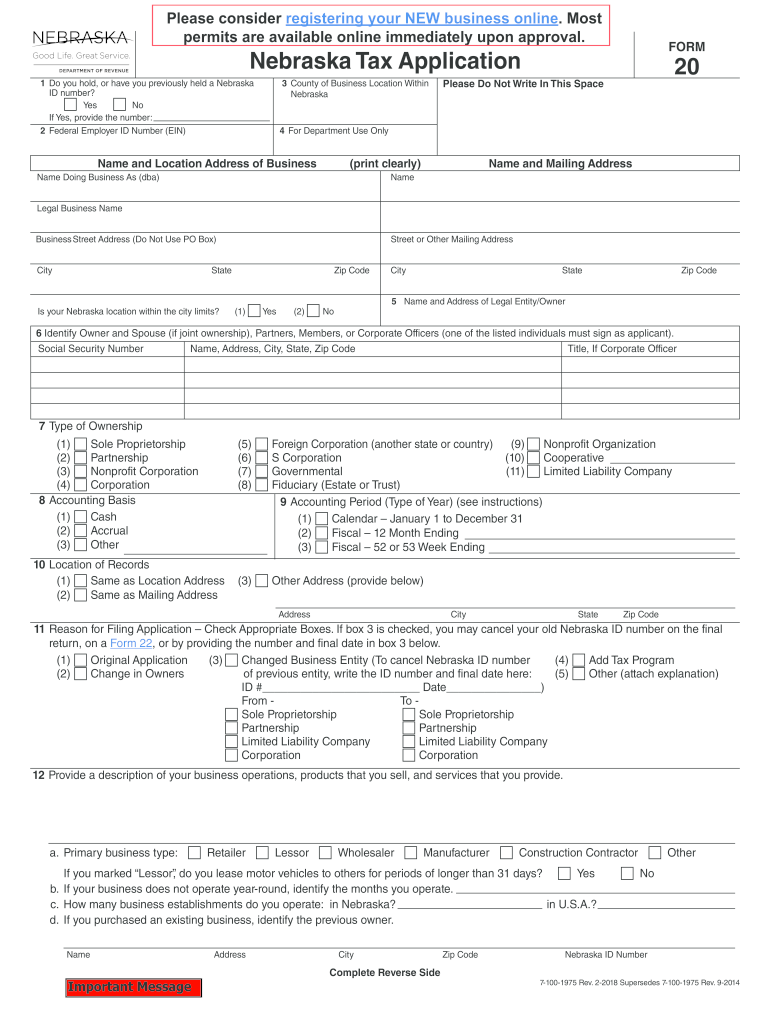

How To Register For A Sales Tax Permit Taxjar

.png)

Job Opportunities Sorted By Job Title Ascending Good Life Great Opportunity

Nebraska Tax Application Form 20 Fill Out Sign Online Dochub

Get Real About Property Taxes 2nd Edition

%20(1).png?upscale=True)

Job Opportunities Sorted By Job Title Ascending Job Opportunities City Of Lincoln Lancaster County

Highest And Lowest Property Tax Rates In Greater Boston Lamacchia Realty