is there a state estate tax in florida

Floridas general state sales tax rate is 6 with the following exceptions. If you live in the state of Florida or have assets in the state of Florida I have some good news for you.

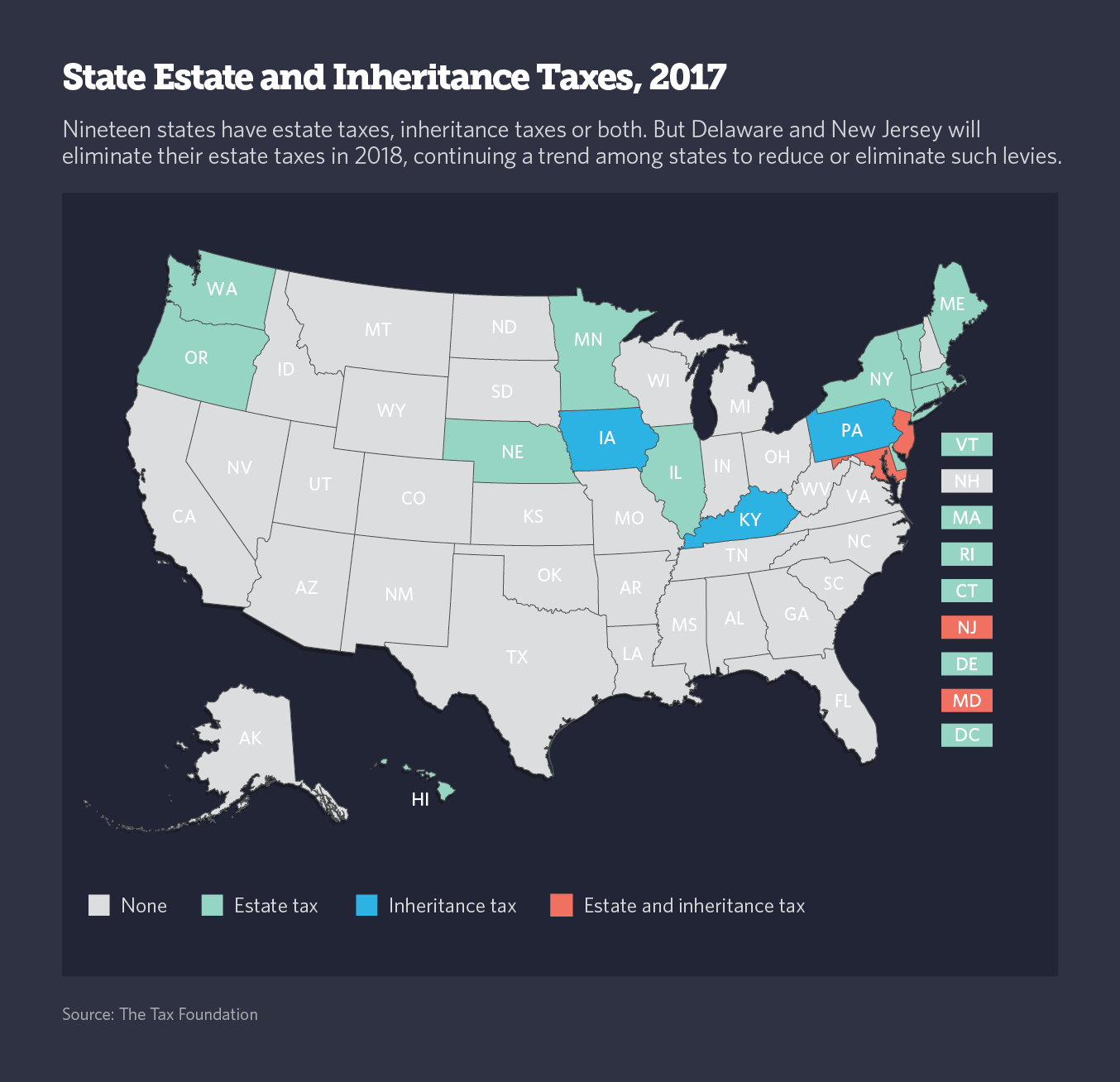

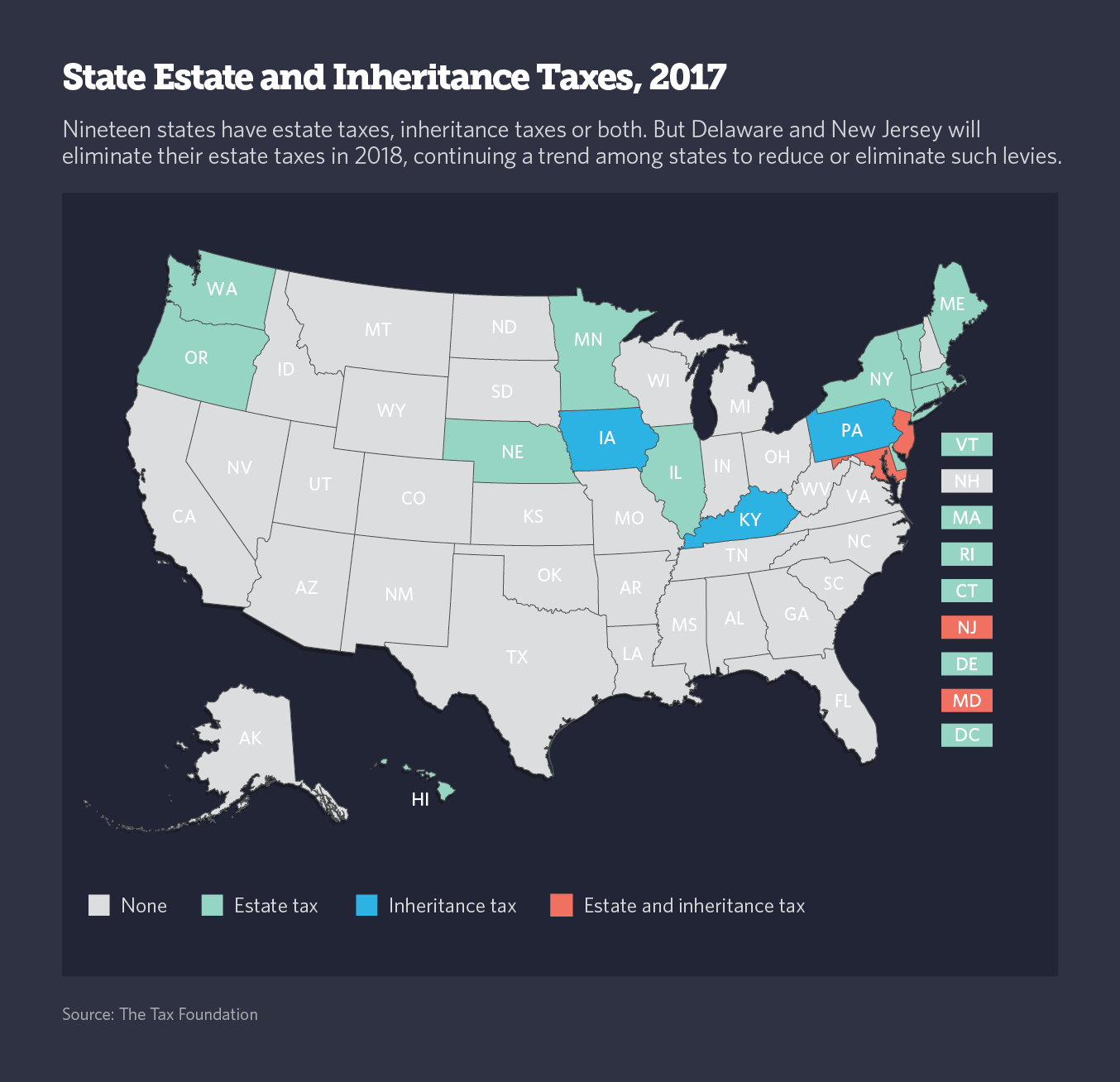

Does Your State Have An Estate Or Inheritance Tax Tax Foundation

Information regarding these and additional taxes.

. The state sales tax is 6 percent. While there are fees and expenses associated with the probate process in Florida the state has no inheritance tax. Bcpao Maps Data Florida Property Tax Map Printable.

The Portability Amendment literally made that tax savings portable so you can now transfer up to 500000 of your accrued Save Our Homes benefit to your new home. An inheritance tax is a tax on assets that an individual has inherited from someone who. Homeowners making up to 150000 will receive 1500 rebates on their property taxes while those earning between 150000 and 250000 will receive 1000.

Be sure to file the following. Major taxes collected in Florida include sales and use tax intangible tax and corporate income taxes. Florida imposes the following taxes within the state.

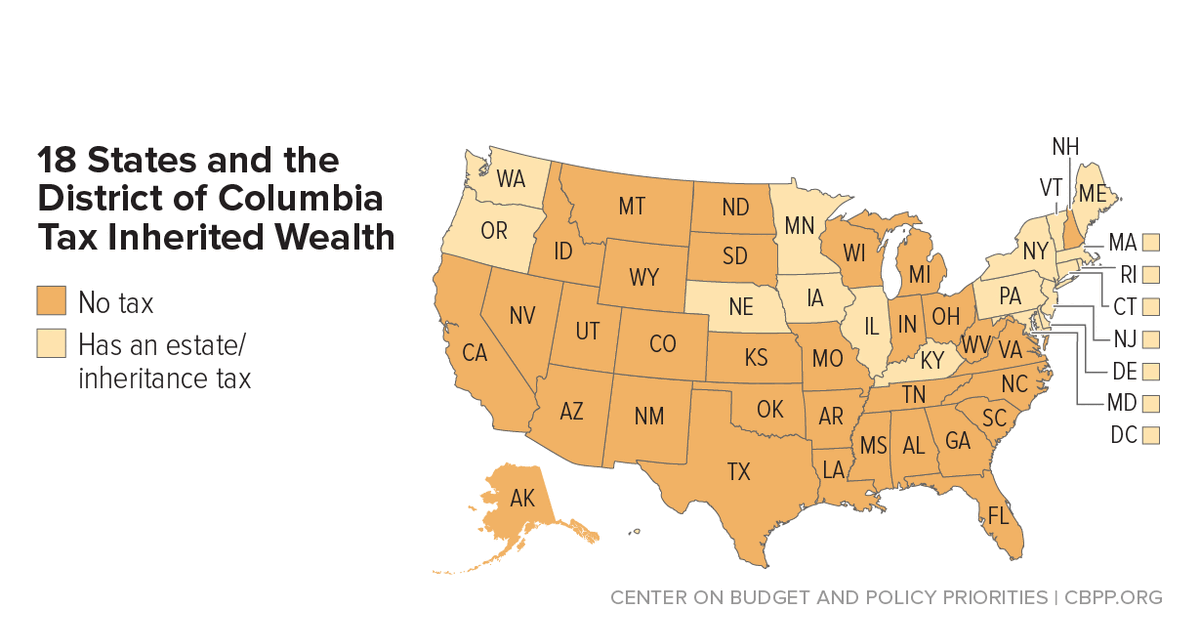

Previously federal law allowed a credit for state death taxes on the federal estate tax return. Florida is one of 38 states that does not. If youre putting together your Florida estate plan its wise to consider whether youll need to pay a federal estate tax.

The good news is Florida does not have a. As of 2020 only six states impose an inheritance tax on its residents but Florida is not one of them. Bcpao Maps Data Florida Property Tax Map Printable.

There are a few states that levy taxes on the estate of the deceased generally referred to as the inheritance tax or the death tax. As a result of recent tax law changes only those who die in 2019 with. The state of Florida doesnt have an estate tax but that doesnt make you exempt from the Internal Revenue Services federal estate tax.

Just because Florida lacks an estate or inheritance tax doesnt mean that there arent other tax filings that an estate must complete. That means that an estate that has a total value of under 1206 million will not pay need to pay federal estate taxes. Florida is easily one of the tax-friendliest states in the nation.

It is calculated for each retail sale and admission charge and certain other. In Florida either the decedent or the estate needs to pay the property tax bill issued in the fall by March 31st. In florida there is no state income tax as there is in other us states.

The federal estate tax for the 2022 tax. Sales tax is added to the price of taxable goods or services and collected from the purchaser at the time of sale. That means that an estate that has a total value of under 1206 million will not pay need to pay federal estate taxes.

A federal change eliminated Floridas estate tax after December 31 2004. The exemption amount will rise to 51 million in 2020 71 million in. Florida Taxes A Quick Look.

Also known as estate tax or death tax the inheritance tax is. If they owned property in another state that state might have a. There is no Florida estate tax.

The top estate tax rate is 12 percent and is capped at 15 million exemption threshold. Since floridas estate tax was based solely on the federal credit estate tax was no longer due on estates of. Theres no income tax the property taxes are low and that likely wont change in the near future.

Florida Tax Rates Rankings Florida State Taxes Tax Foundation

In States The Estate Tax Nears Extinction The Pew Charitable Trusts

Snowbird Bill Would Double The Mass Estate Tax Exemption

2021 Sales Tax Rates State Local Sales Tax By State Tax Foundation

You Ve Received An Inheritance Mckinley Carter Wealth Services

Does Florida Have An Inheritance Tax Alper Law

Florida Tax Rates Rankings Florida State Taxes Tax Foundation

Florida Resources Helpful Links

What You Need To Know About Estate Tax In Florida St Petersburg Estate Planning Lawyers

How Do I Become A Florida Resident Boyer Boyer

In Florida Homeowners Come For The Weather And Stay For The Tax Relief Wsj

Relocating To Florida Understanding Estate Taxes On Your Property The Lynch Law Group Llc Attorneys In Cranberry Twp And Pittsburgh

Inheritance And Estate Taxes Can Impact Ordinary Taxpayers Too

/estate_taxes_who_pays_what_and_how_much-5bfc342146e0fb00265d85b5.jpg)

Estate Taxes Who Pays And How Much

State Estate Taxes A Key Tool For Broad Prosperity Center On Budget And Policy Priorities