ny highway use tax form mailing address

The previous address was. Federal law requires proof that the HVUT tax was paid when you register a vehicle that has a combination or loaded gross vehicle weight of 55000 pounds or more.

Of Tax Finance Highway Use Tax Permit.

. Instructions for Form MT-903 Highway Use Tax Return MT-903-I 122. For forms and publications call. The Federal Heavy Vehicle Use Tax HVUT is required and administered by the Internal Revenue Service IRS.

2 USDOT number 3 Telephone number 4 E-mail address 5 Fax number 6 Legal name 7 Doing. HUTIFTA Application Deposit Unit. Authorizing you to have access to this businesss New York State tax records.

In the instructions or visit our Web site at wwwtaxnygov or call 518 457-5431. Name of person preparing form Number and street City State ZIP code Telephone number. If you have been issued a certificate of registration certificate or if you operate a motor vehicle as defined in Tax Law Article 21 in New York State.

You can also grant a New York State tax preparer access to Web File for you. Be sure to use the proper tables for your reporting method. New York State Department of Taxation and Finance MT-903-MN Highway Use Tax Return.

518 457-5342 For forms and publications call. Any registration application including Forms TMT-1 TMT-39 and TMT-334. New York State Dept.

If you ARE including a payment check or money order mail your return including Form IT-201-V to. Read about the HVUT at the web site of the US Internal Revenue Service or. We offer a number of instructional presentations to help you get started.

Form DTF-406 Claim for Highway Use Tax HUT Refund. Claim for Highway Use Tax HUT. 20 rows DTF-406.

Highway Use Tax Web File You can only access this application through your Online Services account. Enter only numbers andor letters no dashes must be 9 to 11 characters. To change only your address use Form DTF-96Report of Address Change for Business Tax Accounts.

New York State highway use tax return visit our Web site at wwwnystaxgov. Who must file You must file Form MT903 Highway Use Tax Return if you have been issued a certificate of registration certificate or if you operate a motor vehicle as defined in. A Publication is an informational document that addresses a particular topic of interest to taxpayers.

Password - Enter your current OSCAR password. The PO Box addresses above became effective June 1 2014. Use the Step by Step tool to get.

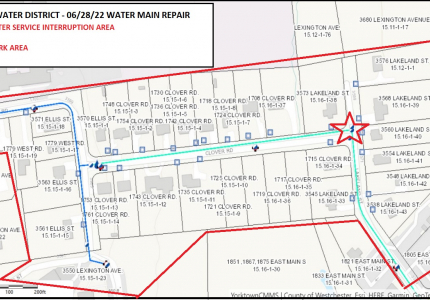

NYS TAX DEPARTMENT RPC - HUT PO BOX 15166 ALBANY NY 12212-5166. Of Motor Vehicles 518 486-9786 Upstate Residents 212 645-5550 or 718 477-4820 Downstate Residents 518 473-5595 Out of State. Form MT-903 is filed monthly annually or quarterly based on.

You can only access this application through your Online Services account. NYS Taxation and Finance Department HUTIFTA Application Deposit Unit WA. New York State highway use tax TMT New York State Highway Use Tax TMT is imposed on motor carriers operating certain motor vehicles on New York State public highways excluding toll-paid portions of the New York State Thruway.

BOX 3644 NEW YORK NY 10008-3644 Bill. If you have not yet enrolled in OSCAR select Enroll Now. Form TMT-1416Application for Highway Use Tax HUT and Automotive Fuel Carrier AFC.

If you are receiving this message you have either attempted to use a bookmark without logging into your account or you have timed out. If you have any questions please see Need. New York State Thruway Road Conditions.

NYS Taxation and Finance Department. Highway use tax schedule totals First complete Schedule 1 or Schedule 2 or both on back page and then enter final. The tax is based on mileage traveled on New York State public highways and is computed at a rate determined by the.

New York State Dept. NEW YORK NY 10008-3929 Business Tax Notices NA PAYMENT COUPON AND REMITTANCE NYC DEPARTMENT OF FINANCE PO. Select the option to change your address.

Paid preparers ID number Paid preparers mailing address For office use only Mail to. Business Tax Form - New Mailing Addresses NYC-UXPS NYC-UXRBS NYC-UXSS Surcharge Return of E-911 Surcharge by Telecommunication Providers NYC-E911 NYC-HTX NYC-HTXB NYC-CRA. If you do not know your password please contact the helpline at 518 457-5735.

If you need a form see Need help. STATE PROCESSING CENTER 575 BOICES LANE KINGSTON NY 12401-1083. New York State Thruway Authority Canals 518 471-5010.

Harriman Campus Albany NY 12227-0163 Phone. 1 Highway use tax schedule totals First complete Schedule 1 or Schedule 2 or both and then enter final totals in boxes 1a and 1b below Schedule 1 total tax Schedule 2 total tax Total highway use tax add 1a and 1b 1a 1b1c Paid preparer use only see instr Firms name or yours if self-employed Firms EIN Preparers PTIN or SSN. Youll receive a bill in the mail for the missing payment.

Highway Use Tax and Other New York State Taxes for Carriers Publication 538 812 Publication 538. To download publications forms and instructions and to obtain information updates on New York.

Gas Prices Don T Reflect Their Environmental Cost Time

Ny Highway Use Tax Hut Explained Youtube

Frictionless Intelligent Business Operations Transformation Services Capgemini

Tax Information Brighton Ny Official Website

Tax Information Brighton Ny Official Website

Pin By Elaine Smith On Ny State In 2022 Gas Tax Highway Signs

To Tame Traffic Bogota Bets Big On Bike Lanes Bloomberg

Vehicle Mileage Tax Could Be On The Table In Infrastructure Talks Buttigieg Says